There are so many recruitment metrics to track, it can be tough knowing where to start. In this article, we share the fundamental recruitment metrics to track and some new exciting trends for 2021 and beyond.

Why use HR analytics?

Despite the global pandemic fundamentally reshaping the way we work and the wider talent market, recruitment metrics still matter. When your organisation has a defined objective, whether it’s growth, revenue, or another goal, you need data to support and measure actions contributing towards this objective. The key results from these should be measurable and capable of being tracked per month and quarter, and by division.

For each of your recruitment objectives, it’s critical to tie it to your organisation’s overall strategic objectives. This enables recruitment to take its well-earned place at the business strategy table.

As a critical organisational function, these recruitment metrics also allow you to track return on investment and the effectiveness of your initiatives.

How often should you measure data?

Measure data as often as it makes sense to do so. For example, you may check in once per week, review once per month, then reflect and tailor your strategy once per quarter.

Busy talent acquisition professionals experience a slew of time pressures, which is why assessing this important data often falls by the wayside. Ideally, your Applicant Tracking System will have ways to automate data tracking for you, for example, on a dashboard. This way, you and your team know how you’re contributing to your wider business objectives and goals.

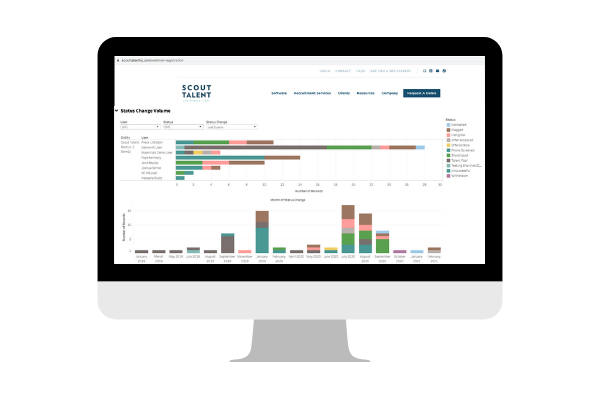

New dashboard that allows Scout Talent :Recruit users to track key recruitment metrics in real time.

Tracking metrics is the essence of data-driven decision making, giving you the information you need to make strategic decisions and make necessary improvements.

Which metrics should you track?

While there are many different metrics you can track, choose recruitment metrics in line with your recruitment and organisational goals.

1. Time to hire

Time to hire is a fantastic measure to gain a sense of your hiring process. It’s a useful starting point, although it shouldn’t be used in isolation. Lengthy hiring processes can be frustrating for both candidates and hiring managers. If this is a challenge in your organisation, measuring time to hire at regular intervals will allow you to identify bottlenecks and make informed decisions to improve your overall processes.

Calculate time to hire from the day you launch your recruitment advertisements to the day you receive acceptance of an offer.

Improving this metric means you’re bringing key skills into your organisation sooner to produce results. This is particularly important for revenue-generating roles and preventing your organisation from losing out on opportunities due to a lack of key skills. Improving this metric also means you’ll likely reduce your overall recruitment spend and see increased satisfaction from hiring managers and candidates alike.

Note, however, time to hire should not be your “be-all and end-all” recruitment metric. Connect hiring speed with your overall organisational growth benchmarks and keep in mind the different recruiting requirements for unique positions.

2. Recruitment activity

When assessing data, it can be easy to forget the “human” element. How long does it take for your organisation to respond to candidates and move them through the recruitment cycle? Is your recruitment team responding to people and managing applications in a timely manner? Tie recruitment activity metrics to your candidate care priorities.

To measure recruitment activity, your Applicant Tracking System may grant you the ability to view application status change timeframes. This allows you to drill down further, identify bottlenecks and improve your processes.

3. Cost per application & cost per hire

How much is recruitment costing your organisation, from preparing your recruitment advertisement, to receiving an acceptance? Ensure you’re managing your spend wisely by calculating cost per application and cost per hire.

In the following calculations, internal costs represent time investments from internal recruiters and hiring managers. External costs represent your recruitment advertising costs and any recruitment outsourcing costs.

Internal costs + external costs / total number of applications = $ cost per application

Internal costs + external costs / total number of hires = $ cost per hir

4. Sourcing channel effectiveness

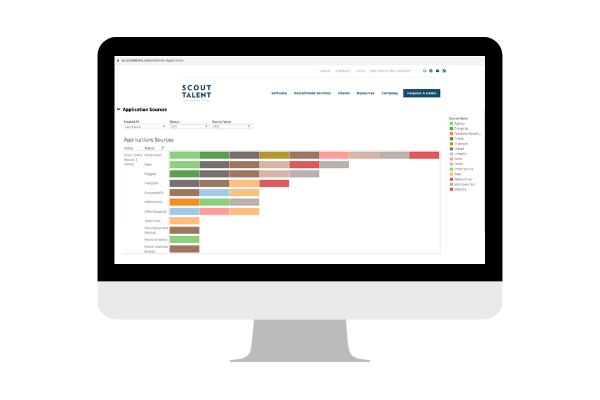

Track and compare both your application sources and successful hiring sources. Your highest source of applications may not necessarily equate to your most successful hiring sources. For example, you may receive the majority of applications through Seek, but your most successful hires are made through employee referrals.

Visual reporting functionality Scout Talent :Recruit users assess to track sourcing channel effectiveness

As with all data, use it to gain insights and inform your decisions. You may like to experiment in changing your strategy, trialling different messaging or investing in other channels.

Assess your spend per channel too. For example, you may only receive two applications on a niche job board, but have a minimal spend. (If you made a hire from this source, that would be a 50% conversion rate!)

Remember too, just because you’re getting results through a particular channel, doesn’t mean you shouldn’t explore additional channels to see what works best. For example, proactive sourcing channels may require the same amount of spend, but result in higher quality candidates.

5. Mobile views and application rates

Mobile data tracking has become a new, popular metric to track. Mobile internet daily media consumption has grown exponentially (504% since 2011!). 9 out of 10 candidates view jobs on mobile and promoting jobs as mobile-friendly application experiences can increase application rates by 11%. With more candidates viewing and applying for roles via mobile, it’s a great idea to track your mobile views and application rates.

It’s a great idea to optimise your job ads with shorter, sharper text and plenty of spacing to ensure your ads are mobile-optimised. Depending on your industry, role and target talent demographic, you may like to consider including screening questions in the second stage of your recruitment process – as long-form screening questions can be difficult to complete via mobile. Some employers allow candidates to apply through Seek and LinkedIn, where their resumes are already uploaded and it’s easy to apply.

Note, high mobile views and low mobile application rates isn’t necessarily a problem though. Research reveals many candidates view jobs ads on mobile, then apply for the role later on desktop.

6. Indicator metrics

As mentioned, there are many metrics you could choose to measure. Some organisations track:

- applicant source

- first-year hire retention rate

- offer acceptance rates

- recruitment advertisement views

- recruitment advertisement conversion rates (views to applications)

- social media engagement

- and/or other metrics.

These metrics can act as a “trigger” or alarm and provide deeper insights into your strengths and areas for improvement. From these metrics, you may need to investigate other metrics further, secure external expertise, and/or adjust your strategy.

For example, low advertisement view rates can result in a low volume of applications; which would indicate you need to adjust your recruitment advertising strategy. Or, low social media engagement overall could indicate your employer branding and recruitment marketing strategy could need some work.

Remember, your metrics are only as good as your data inputs. (For example, if your recruiters aren’t using applicant status changes correctly in your Applicant Tracking System, your data will be incorrect.) Consider the pros and cons of partnering with an external recruitment specialist to help you reach your goals sooner.

Data-driven decisions are the most effective, as you don’t have to rely on gut feel. It also allows you to focus on what matters most. Use data analytics to test your assumptions and measure success. You don’t need to measure all these metrics, only the ones that suit your recruitment and organisational goals. (For example, do your goals focus on revenue, applicant conversions, retention or brand awareness?)

Use data to experiment and test. For example, experiment with alternative sourcing channels, such as talent pooling.

Great recruitment marketing equates to a strong return on investment through high-quality applicants, better hires, reduced time to hire and cost per hire, increased acceptance rates and improved retention. So choose the right metrics in line with your recruitment goals, and start measuring them today!

For assistance with reporting or measuring recruitment metrics, speak to our knowledgeable Recruitment Marketing and Employer Branding Specialists, email us at info@scouttalent.com.au, or call us on 1300 366 573.